So, you’re looking into starting your own law firm in California? Good for you! I’ve been there, and from my experience, I can tell you it’s a heck of a lot of fun, a heck of a lot of work, and (if you do it correctly) immensely rewarding both personally and financially.

Let’s talk about the process, shall we?

First of all, if you’re reading this, there’s at least a part of you that has already been considering this path. Maybe you’ve been dissatisfied with your current job for years. Or perhaps the pandemic taught you that working in isolation is good for your soul.

Whatever the reason, I know that the mere thought of starting your own law firm can be at once overwhelming, exciting, scary, and exhilarating.

In this article, we’ll give you a checklist of the things you must do to start your own law firm in California. Of course, you’ll want to do more detailed research once you choose a path, but this is a good place to start.

A checklist for starting your own law firm in California

Once you actually dive into starting your own law firm, you may feel like there are more things to get done than you can possibly handle.

One good way to wade through the process is to create a checklist of things that you do before you open your doors. Here are our top suggestions:

Read the rules

As with anything in the law, a myriad of rules and regulations exist to dictate how you go about starting your own law firm.

Fortunately, the California State Bar provides guidance in this area. Since they are the body that will oversee your new law firm, you’ll probably want to pay close attention to their advice.

That link will also give you an overview of all the paperwork you need to file to start your law firm.

Choose a business entity

In California, there are two principal types of business organizations available to law firms: a limited liability partnership and a professional law corporation.

In addition to studying the liability structures and risks associated with each, you’ll want to consult with an accountant to discuss the tax implications of each business form.

We’re not going to go into the details of these business entities here. Add this to your list of things to research in greater detail.

Here’s a rundown of the main takeaways you should take into account when getting started:

Limited liability partnerships

The State Bar of California’s Limited Liability Partnership (LLP) program allows professional partnerships to limit their vicarious liability for the acts of their partners and employees.

Currently, there are around 2,700 certified limited liability partnerships. Starting May 18, 2023, the Board of Trustees approved fee increases for LLP application and renewal to cover rising administrative costs. The fee changes are as follows:

- Initial Certificate of Registration Application (First Two Partners): Increased from $100 to $110.

- Initial Certificate of Registration Application (Each Additional Partner): Increased from $50 to $55.

- Initial Certificate of Registration Application (Cap): Changed from $2,500 with a cap to having no cap.

- Annual Renewal (First Two Partners): Increased from $75 to $85.

- Annual Renewal (Each Additional Partner): Increased from $25 to $30.

- Annual Renewal (Cap): Changed from $2,500 with a cap to having no cap.

LLPs must annually renew their certification by submitting an Annual Renewal form.

The 2023 Annual Renewal will be mailed in August, and the deadline for submission is October 2, 2023. LLPs with a name change must report it to the State Bar within 45 days, and the required forms for the name change can be found on the forms webpage or obtained from the Secretary of State’s LLP filing unit. There is no fee from the State Bar for requesting a name change.

Law corporations

The State Bar of California’s Law Corporations Program certifies professional corporations that want to practice law in compliance with applicable statutes and court rules.

The program ensures these corporations adhere to relevant provisions. Starting May 18, 2023, there will be fee increases for Law Corporations’ application and renewal. The new fees are as follows:

- Application: Increased from $200 to $250.

- Renewal: Increased from $75 to $100.

- Late Fee Penalty: Remains unchanged at $110.

Law corporations must annually renew their authorization to practice law by submitting an Annual Report and Renewal. The deadlines for the 2023 renewal are as follows:

- Timely deadline: March 30, 2023, with a fee of $75.

- End of grace period: May 3, 2023, with a fee of $75.

- Final deadline with penalty: July 19, 2023, with a fee of $185.

Payments must be submitted by check and mailed to the specified addresses. Online credit card payments, in-person payments, or payments over the phone are not accepted.

Common reasons for returned applications include incorrect bylaws language, incorrect or unsigned certificates of the secretary, and photocopies of Secretary of State forms.

The law corporation’s name must comply with the California Rules of Professional Conduct and include wording denoting corporate existence.

Pick a practice area

Do you know what kind of practice you’re creating?

The truth is, there are areas of the law that are better suited for solo practitioners or small practice groups than others.

Before you decide to become a generalist, give some thought to the pitfalls of that type of practice. While it may be tempting to take every matter that comes your way, that may not be the best decision from a business perspective. Law is complicated, and you can only be truly great by specializing in one area.

When starting a law firm, selecting the right practice area is a pivotal decision that profoundly impacts the firm’s success and growth. To make the right choice, several key considerations come into play.

Firstly, consider how personal passion and interest play a significant role. Identifying the area of law that genuinely excites and motivates you is crucial for job satisfaction and dedication.

Secondly, assessing your skills and expertise helps determine where you can offer the most value to clients. Building a firm around your strengths can provide a competitive advantage.

Additionally, researching the market demand for legal services in your local area is essential. Understanding the areas with growing demand ensures a steady flow of clients.

Examining the competition in various practice areas is vital to gauge the difficulty of establishing your firm in a particular niche. Analyzing the target clientele and their needs is also crucial for tailoring your services and marketing efforts effectively.

Financial viability is another factor; selecting a practice area that aligns with your financial goals is essential for the firm’s sustainability. Staying updated on future trends in the legal landscape helps anticipate shifts in demand and adapt your services accordingly.

Finally, keeping long-term goals in mind is crucial. Whether you envision a solo practice or expanding and hiring other attorneys, your chosen practice area should complement your growth plans. Seeking advice from experienced attorneys, mentors, and colleagues can offer valuable insights as you embark on this important decision.

Remember, while selecting a practice area is significant, it’s not set in stone. As your firm evolves, you can explore new practice areas and adapt your focus accordingly.

Write your business plan

Business plans aren’t easy or quick to create, but they are important to the ultimate success of your new law firm. Practicing law and running a successful law firm are two entirely different things.

Writing a clear business plan will force you to think about things like funding, marketing, and goal setting. You’ll map out your growth plan and do research that shows you the problems you’re likely to encounter along the way.

And I know you didn’t learn how to write a business plan in law school. That’s ok.

Roughly, you want something that covers all these bases, like this:

- Executive summary: Begin with an executive summary that provides an overview of your law firm, its mission, vision, key objectives, and target market. This section should be concise and capture the essence of your entire plan.

- Description of the firm: Provide detailed information about your law firm, including its name, legal structure (e.g., sole proprietorship, partnership, LLP, PC), location, practice areas, and any unique selling propositions.

- Market analysis: Conduct thorough research on your target market and competition. Identify your ideal clients, their needs, and the demand for legal services in your chosen practice areas. Analyze your competitors and highlight what sets your firm apart.

- Services and practice areas: Describe the legal services you will offer and the practice areas you will specialize in. Explain how your expertise aligns with the needs of your target market.

- Marketing and sales strategy: Outline your marketing and business development strategies. Detail how you will reach and attract clients, including online marketing, networking, referrals, and other promotional efforts.

- Financial projections: Present financial projections for the next three to five years, including income statements, balance sheets, and cash flow statements. Consider startup costs, operating expenses, revenue projections, and break-even analysis.

- Risk management: Identify potential risks and challenges your law firm may face and explain how you plan to mitigate them. Address issues like malpractice insurance, compliance with ethical guidelines, and client confidentiality.

- Implementation plan: Lay out a timeline for executing your business plan. Include milestones and measurable goals to track your firm’s progress and success.

Remember, a well-crafted law firm business plan serves as a guiding document for your firm’s growth and development. It’s essential to regularly review and update the plan as your firm evolves and market conditions change.

In addition, seeking input from colleagues and contacts will provide very useful insights and ensure a comprehensive and effective business plan.

Don’t forget marketing

The mistake many lawyers make when they start their own firm is that they overlook the considerable effort it takes to bring clients to their practice.

Unless you have clients following you from your old firm, you’re going to have to put maximum effort into this unbillable part of your practice.

Even if you do have lots of happy clients right now, you’ll probably have a lot less success bringing them along to your new firm than you expect. People are fickle and marketing is hard.

The good news is that there are highly useful resources available that are specific to law firm marketing. Those should bring you up to speed quickly.

That said, don’t forget that the State of California has very specific rules about advertising and solicitation.

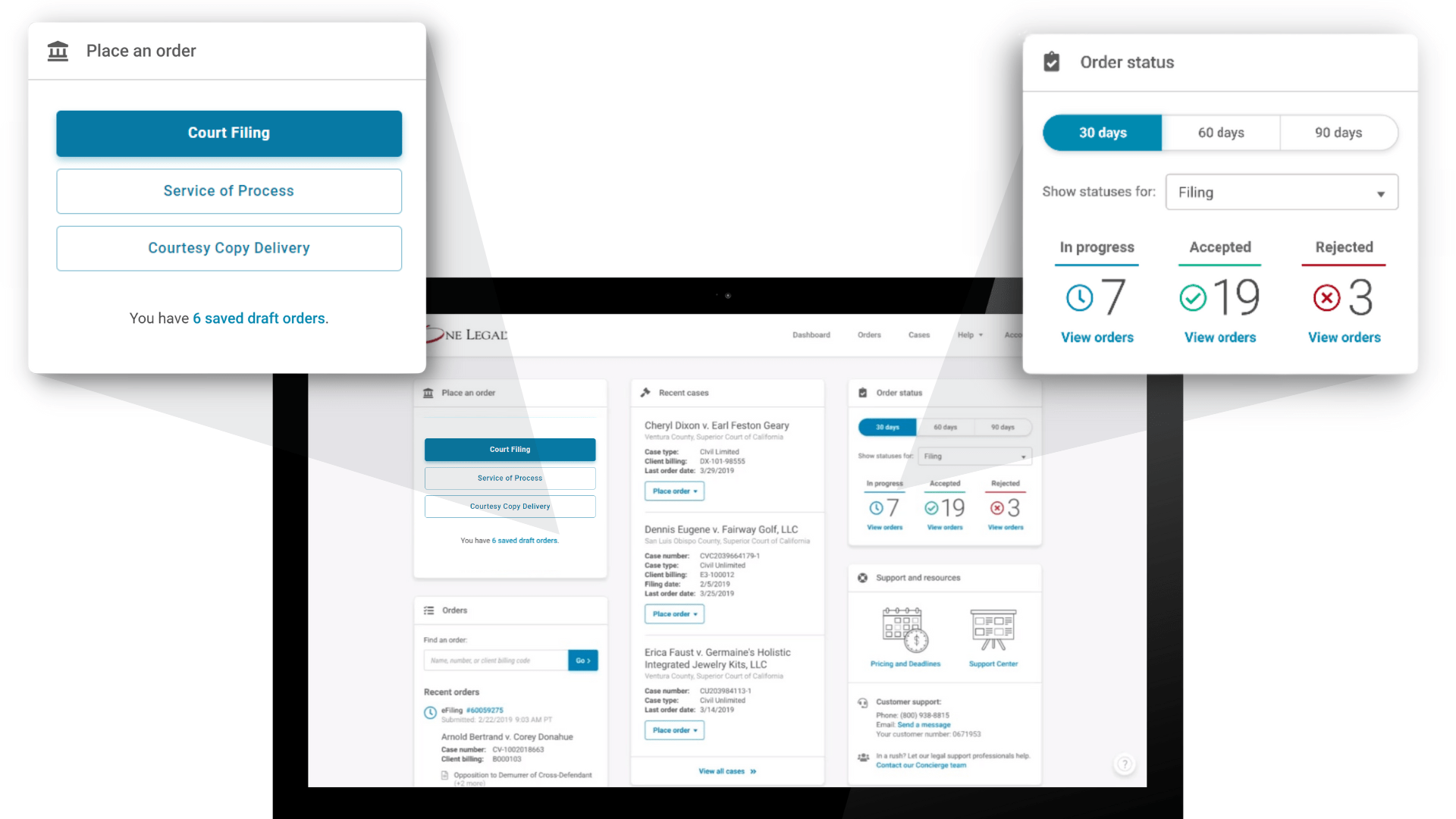

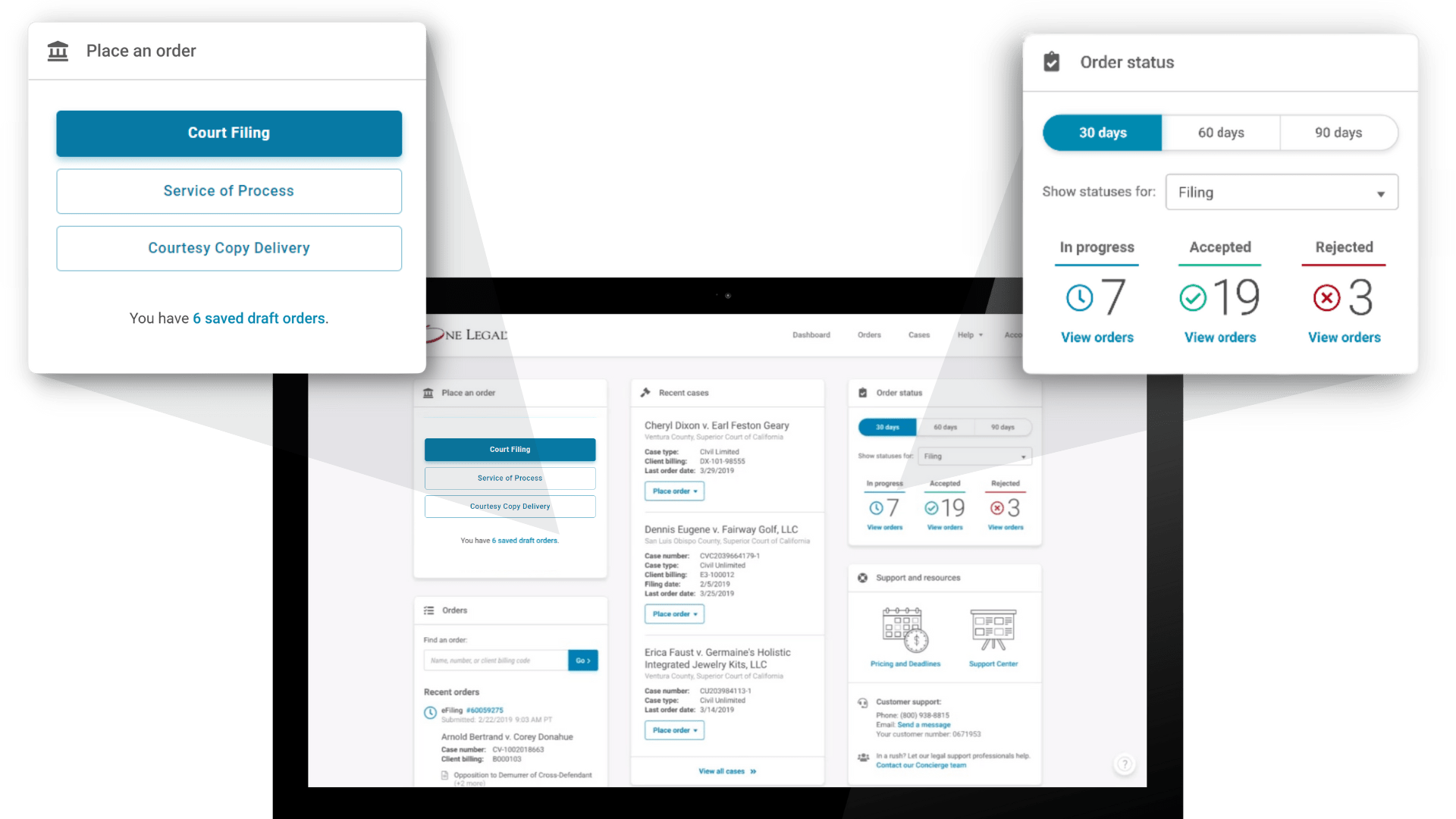

Choose tools and services that enhance your new practice

Unless you have an endless stream of money coming into your new law firm, you’re going to have to find ways to automate things that your old firm may have handled the old-fashioned way.

Fortunately, you’re living in a time when many cumbersome processes can be handled quickly and efficiently online.

Things like court filings, service of process, case searching and tracking, calendaring, UCC searches, and property research — just to name a few — are all available with a few clicks of the mouse.

Look beyond legal software, too. You’ll be running a business, not simply practicing law in your own office. Assets like project management software, email marketing systems, and team communication tools keep your firm running smoothly.

Choose the best team for you

It’s tempting, when starting your own law firm, to go it alone. It can’t be that hard to fill every role within a firm yourself, right?

Wrong. Take it from me.

To the extent you’re able, you should surround yourself with the very best people available to you.

Even if you can’t afford to hire today, it’s never too early to start fostering relationships with people who may become critical team members in the future.

You can fill in gaps with freelance legal support and/or a good virtual assistant.

Don’t forget insurance

None of us wants to think about malpractice claims, but all of us should — especially when you’re just starting a new firm and are overwhelmed with new business tasks.

Moreover, you’re now in charge of things like workers’ compensation insurance, disability insurance, life insurance, etc.

The California State Bar provides great resources for finding insurance policies. Skipping this step can destroy your business, so get your portfolio in place early and review it often.

Conclusion

Congratulations on your decision to start your own law firm.

While we understand this isn’t an exhaustive checklist of everything you’ll need to do to get your new business off the ground, we hope it helps and we wish you the best in your new endeavor.

Here’s one last tip before you go: stay open and keep learning.

The legal world changes fast, and staying relevant is one of the big challenges you’ll need to tackle. Keep reading, listening, and networking. Those habits will help you keep your business and your legal career thriving when starting your own law firm.